How to File a Property Damage Insurance Claim (Without the Headache)

How to File a Property Damage Insurance Claim (Without the Headache)

Why It Matters

When property damage strikes—whether from a storm, fire, or accident—it’s crucial to file your insurance claim the right way. Mistakes can cause serious delays or even denials. Filing properly ensures you receive the compensation you’re entitled to and recover quickly without added frustration or cost.

TLDR Quick Guide

- Document the damage immediately with photos and video

- Contact your insurance company as soon as possible

- Review your policy for covered damages and deductibles

- Get repair estimates from licensed contractors

- Keep a record of all communication and receipts

Step-by-Step: Filing a Property Damage Insurance Claim

Understand What Your Policy Covers

Before you file anything, take time to read through your insurance policy. Knowing what’s covered—and what isn’t—can save you time and help set realistic expectations. Pay close attention to deductibles, exclusions like flood or earthquake damage, and any special filing deadlines that may apply.

Document Everything Right Away

Your claim’s strength depends on your ability to show proof. As soon as it’s safe, start documenting all visible damage. Take detailed photos and video from multiple angles, and make a list of damaged items, including approximate values. It’s important not to discard any items until an adjuster has had the opportunity to inspect them.

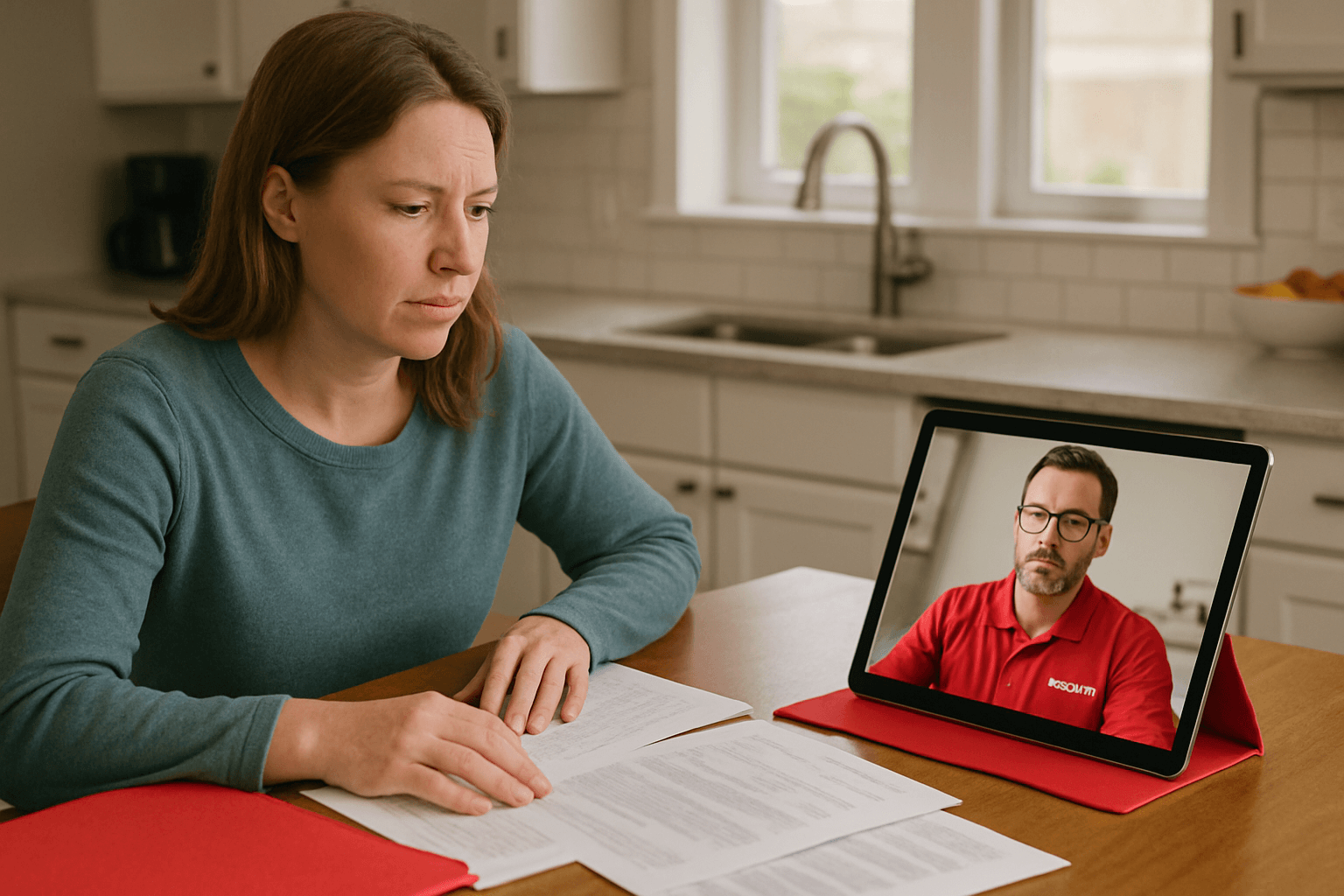

Notify Your Insurance Company

Once documentation is in place, contact your insurer to report the incident. Some policies have strict timelines, so don’t delay. When speaking with the representative, provide a clear summary of the damage and ask for a claim reference number. Make sure you save a copy of everything you submit, including your initial notification.

Meet the Adjuster

In most cases, the insurance company will send an adjuster to assess the damage. Be prepared to walk them through the affected areas and provide copies of your documentation. Your input can help shape their report, so be thorough and proactive during this visit. Once they complete the inspection, ask for a copy of their findings for your records.

Get Repair Estimates

While the adjuster will give their own valuation, it's smart to seek independent estimates from licensed contractors. Not only will this give you a realistic sense of repair costs, but it also provides leverage if the insurer’s offer is lower than expected. Provide those estimates as part of your claim documentation to support your case.

Monitor Your Claim’s Progress

Stay engaged throughout the process. Keep track of every call, email, or message exchanged with your insurer. If your claim is delayed or seems stalled, follow up consistently and ask for updates. If issues persist, don’t hesitate to escalate or involve a licensed public adjuster who can advocate on your behalf.

Key Mistakes to Avoid

Filing late is one of the most common reasons claims are rejected or reduced. Always report damage promptly. Another mistake is relying solely on the insurance adjuster’s assessment without getting your own quotes. Incomplete documentation can also sabotage your claim—be meticulous in how you record and report damage. And if the offer is far below your expectations, don’t accept it without negotiation or expert review. In complex or high-value cases, hiring a public adjuster might be a smart move.

Key Takeaways

- Time is critical—file immediately after damage occurs

- Documentation is your best defense

- Don’t rely solely on the insurer’s adjuster

- Get independent repair estimates

- Know your rights and when to escalate the claim

Frequently Asked Questions

- How long do I have to file a property damage claim?

Most insurance policies require you to file a claim within 30 to 60 days of the incident, though this varies. Always check your specific policy for deadlines. - Can I start repairs before the adjuster arrives?

You can make emergency repairs to prevent further damage—such as stopping a leak or boarding up windows—but document everything thoroughly before making changes. - What if my insurance company denies the claim?

You have the right to appeal. Review the denial letter, gather supporting documentation, and consider hiring a public adjuster or attorney to advocate for a fair review. - Is it worth hiring a public adjuster?

In cases involving significant damage or claim disputes, a public adjuster can help you receive a more accurate payout by negotiating directly with the insurer. - Will my premium go up after filing a claim?

Filing a claim can affect your premiums, depending on the type and frequency of claims filed. It’s best to discuss this with your insurance agent for specifics.